What We Offer

COMPREHENSIVE FINANCIAL PLANNING FOR A TRANSPARENT, FLAT FEE

OUR SERVICES

We’re here to help you build a comprehensive strategy that provides the flexibility to enjoy life today, all while still preparing you for the future.

Retirement Planning

Our retirement planning services help you reach your goals without the risk of running out of money. We want to give you the confidence and clarity so you can spend time doing the things that most important to you. A retirement plan is a living and breathing document. We use an advanced financial planning software to build your plan, track its success rate, adjust for life's unknowns, and communicate the results with you in plain English.

Invest Wiser

Develop a cohesive investment strategy to reduce risk and improve returns

Retire Better

Aligning all the moving parts of your financial life to create a successful retirement

Reduce Taxes

Ongoing tax planning to reduce your tax bill

Tax Planning

Our goal is to optimize your tax planning so that when you pay Uncle Sam, you don’t leave him an unnecessary tip. We also stay up-to-date with the ever-changing tax laws to help our clients take advantage of all tax deductions, tax credits, and tax exemptions that Congress and IRS will allow.

Annual Tax Return Analysis

We will actively ask for your tax returns, put together an analysis, and work directly with your accountant to proactively suggest strategies for the future.

Coordination & Timing of Income Streams

We evaluate your pension, social security, and required minimum distributions.

Annual Roth Conversions, Asset Location, Charitable Giving Strategies

Evaluating and implementing these strategies will help us lower your tax bill.

Investment Management

Investing isn't as hard as it sounds. Most advisors make this overly complex with high fees attached. The value is in simplicity. Our investment services include portfolios that are carefully designed to help investors with the following:

- Improve returns

- Reduce risk, and

- Achieve their unique financial objectives

We believe in a simple, 4-part investment philosophy that includes keeping costs low, diversifying globally, limiting taxes, and improving investor behavior.

Remember, we charge a flat fee, not a percentage of Assets Under Management (AUM). At the industry standard of 1%, why should a client with $1 million pay double the amount of a client with $500,000 when they both receive similar services? Will the advisor encourage the client to spend less in retirement because that's how they’re compensated? I’ll let you decide.

Lower Costs

It’s been proven that investments with lower costs have a track record of providing higher returns. Therefore, we strive to not only offer competitive pricing for our advisory services, but to also recommend investments with low internal costs, including low-cost mutual funds and ETFs.

Diversification

We believe (and it has been academically proven) that no one can accurately and consistently predict the best-performing asset class or sector over a long period of time. We also believe over-concentrating in one sector or asset class can lead to unnecessary risk. That is why we maintain a healthy level of diversification in all of our model portfolios, which include large cap, small caps, domestic, international, and emerging markets holdings.

Tax Minimization

Taxes can result from capital gains and/or dividends, and higher taxes can be likened to higher fees. Higher fees typically mean lower returns. To reduce the impact of taxes for our clients, we recommend investments with low turnover and implement strategies like tax-loss harvesting to keep taxes to a minimum.

Improving Investor Behavior

We have a strong belief that good investor behavior is the most impactful component of any good, long-term investment outcome. Part of successful investing involves the discipline to not make any knee-jerk reactions, like selling investments at a loss. We believe another key is to create a plan first and let your plan dictate your investment choices. As markets fluctuate, it’s important that you’re able to properly evaluate your plan and that you are confident enough to stick to it. That’s why we spend so much time with clients on building a thorough financial plan and educating on what it takes to be a successful investor.

Risk Management Planning

We believe that risk management is the absolute cornerstone of a comprehensive financial plan. We want to make sure you, your assets, your most valued possessions, and your family are all protected. You work too hard to leave these areas of life vulnerable, and we’ll work with you to determine the proper amount of coverage for your needs.

This could include things like:

- Emergency savings planning

- Long-term disability planning

- Life insurance

- Long-term care planning

- Auto & home insurance

- Umbrella insurance

- Health insurance

Remember, we are NOT fee-based. We ARE Fee-ONLY. We are a commission-free financial planning firm. We get paid exactly $0 when we help you buy an insurance policy. By not accepting commissions, you don't have to worry about us recommending something you don't need.

Comprehensive Insurance Analysis

We will help you shop the entire market to find the best policy at the best price. We also help unwind insurance policies that were wrongfully sold to you.

Annual Reviews

Each year we’ll go over your employer’s open enrollment packets so you can take full advantage of your benefits and protections.

Cash Flow Advisement

We’ll review and provide insight around budgeting, debt management strategies, and planning for both short- and long-term goals.

Estate Planning

We help clients with estate planning to ensure their assets are titled properly, protected from estate taxes, and left in control of their heirs. We know the estate planning process can be confusing and intimidating, but we firmly believe in the importance of getting these key documents in place. That is why we offer to accompany our clients at each estate planning meeting as they discuss their wishes with their attorney. We’ll help you ask the right questions to get your estate plan done properly.

Licensed Attorney Facilitation

We’ll work in conjunction with your attorney throughout the estate planning process.

Ongoing Oversight

We consistently monitor your estate plan to periodically update beneficiaries, trustees, agents, and more.

Reducing Conflicts of Interest

"Show me the incentive, and I will show you the outcome” – Charlie Munger

Imagine you have some extra savings in your bank account. Should you pay off your mortgage or invest in the market? If your advisor charges the typical 1% fee, then there is a financial incentive to steer you away from paying off the mortgage. Instead, your advisor might encourage you to add the extra savings to your investment portfolio. And conveniently, your advisor will earn a higher fee if you follow their advice.

There are many other scenarios where the typical 1% fee causes conflicts of interest. From 401(k) rollovers to the timing of Social Security claims, the typical financial advisor earns more or less depending on what you choose to do. And in many of these situations, the advisor’s financial incentive will conflict with your own best interests. You don’t want to be in a situation where you need to make an important decision around your retirement, and you can’t have complete trust in the advice provided to you.

Our flat fee can reduce or eliminate much of the biased advice in these situations. It allows us to remain 100% focused on your financial success.

A Quick Cost Comparison

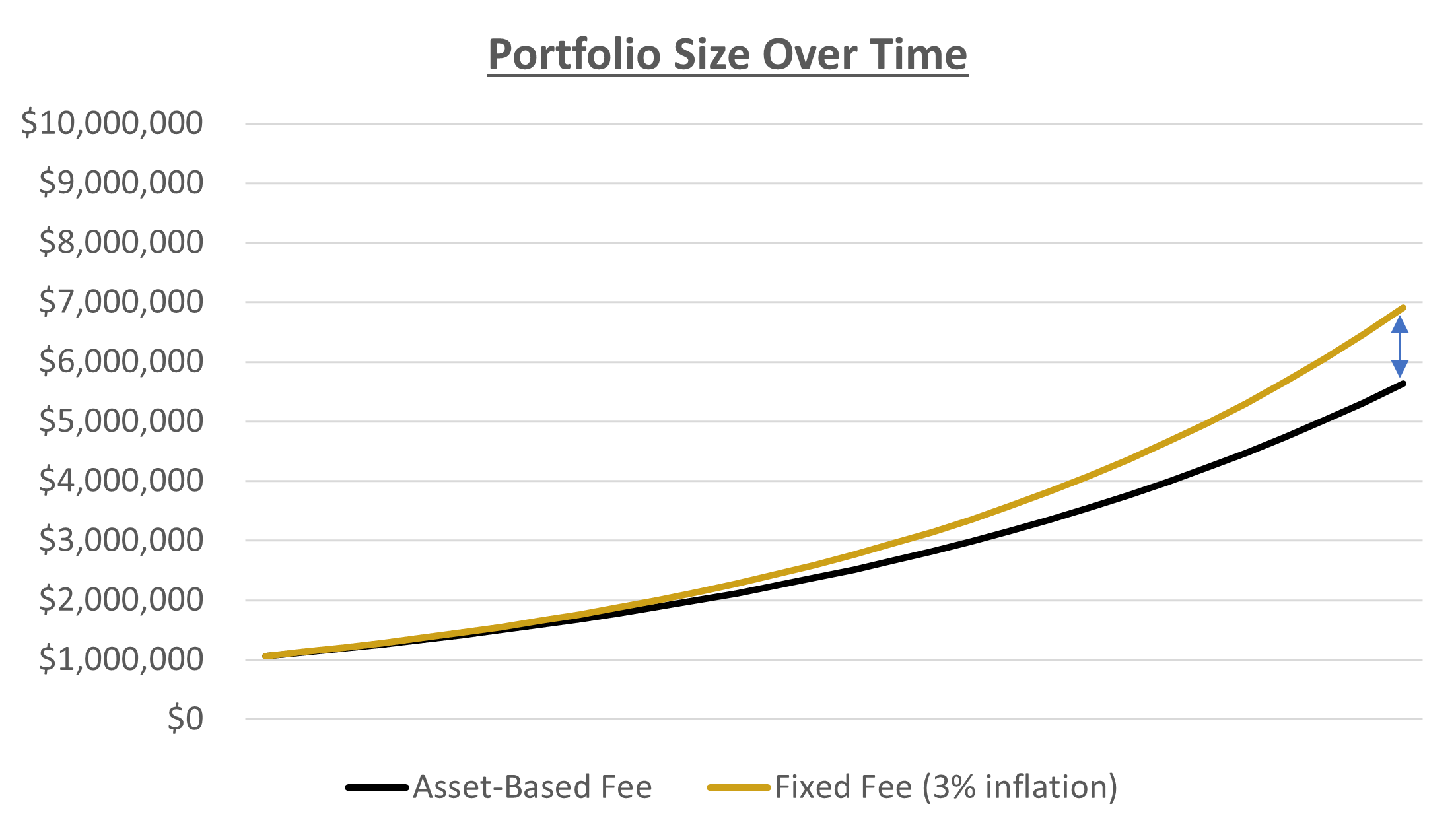

The typical 1% advisory fee can present significant problems for clients. As the portfolio grows over time, these asset-based fees can act like an anchor on investment growth.

For example, if you start with a $1 million portfolio and earn a 7% return before fees, after 30 years our flat fee structure results in $1.2 million of additional wealth compared to the asset-based fee. That extra cost can erode your chances for long-term financial success.

CALCULATOR DISCLOSURE:

This calculator illustrates the difference between an asset-based fee and flat fee of $6,000 per year. This calculator is for informational purposes only. It does not account for the effect of taxes, inflation, investments fees, or other important factors.

PRICING

Invest in yourself.

We charge a transparent flat fee based on complexity. The way it should be. PERIOD.

Our fee is determined after reviewing your personal situation and will be 100% transparent once our assessment is complete.

Our fee includes financial planning, retirement planning, investment management, coaching, consulting, and all services offered by Legacy Wealth

Planning.

Looking for more information?

The financial planning process can introduce a lot of questions. Learn more about your opportunities, who we are, and how we can help you.

Stay in touch

Gain access to educational monthly newsletters, straight to your inbox.

"*" indicates required fields