The Legacy Difference

REAL PEOPLE. REAL PLANNING. REAL RESULTS

WHAT TO EXPECT WHEN WORKING WITH US

We believe you deserve to work with a true fiduciary at a fair price. No hidden fees. No commissions. Just transparency.

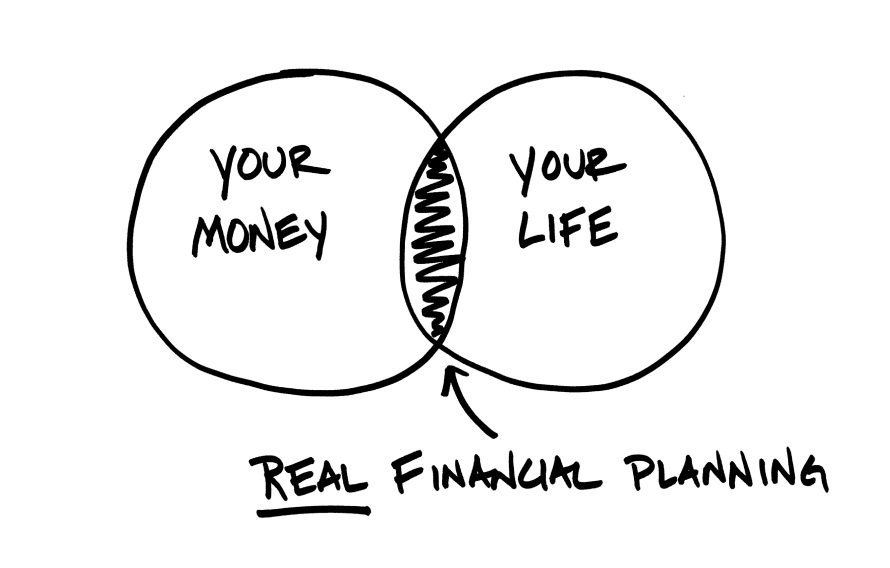

Your Money. Your Life.

We believe the foundation of real financial planning is based in establishing the right balance between your lifestyle and your money. Investing and saving money are important, but money is just a tool. It's far more critical to align your time, money, and values to live the best life possible.

IMAGE BY BEHAVIOR GAP

THE LEGACY EXPERIENCE

What you can expect

1

Schedule 20 Minute Call

A 20-minute phone call will give us both a chance to make sure your situation matches our expertise and answer any questions you may have.

After all, you wouldn't see a Cardiologist if you needed foot surgery!

2

Team Meeting

Like a doctor, it's important to diagnose before we prescribe.

The next step is meeting with our team (in-person or virtually). During this 1-hour meeting, our team will get crystal clear on your financial goals, needs, and concerns.

3

Review Assessment

With the Assessment complete, we will have another 1-hour meeting to review our findings and recommendations.

We will explain exactly what you can do to improve your retirement plan, lower taxes, and optimize your investments.

Meet AJ Erzen, CEPA®

I’ve worked for large companies in the financial world for my entire career. They all spent more time talking about how they can pad their own wallets rather than do what's right for the consumer. From making horrible recommendations to maximize a commission, to charging extraordinarily high fees that the client doesn't understand, I've seen it all.

In order to be held to the highest standard possible, I realized I would have to do it myself.

In September 2022, I launched Legacy Wealth Planning.

I wanted to build a firm that instilled some basic old-school principles I learned from my parents. For example, treat others as you wish to be treated, be a good person, do things the right way, keep your word, and work your butt off.

When I am not crafting a financial plan, you can find me and my wife running around with our three wild boys (Miles 11, Hayden 9, and Cameron 5) to one of their sporting events. Otherwise, I love Greenbay Packers Football, Golfing, a good workout, or hanging out with family and friends.

Take the next steps.

Solidify a simple financial plan with a partner you can trust

10 Questions You Should Ask Every “Financial Advisor”

Not sure who to trust? We get it. Unfortunately, not all financial advisors are created equal – NOT BY A LONG SHOT.

Download GuideStay in touch

Gain access to educational monthly newsletters, straight to your inbox.

"*" indicates required fields